LazyPay Loan App Review

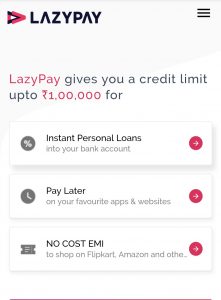

Lazypay instant loan app for the laziest people to get instant cash online. Get Instant Personal Loans up to Rs. 1 lakh with LazyPay, through an easy digital process and minimal documentation.

Surprise your loved ones with festive gifts, go on that dream trip with your friends, buy yourself the latest smartphone, or meet all your emergency expenses. In this post, we will cover all the things you can do on lazy pay and all the aspects of Lazypay instant loan app and wallet. Check Latest Best 10 Online Loan Apps In India

Let’s Start unbiased review of LazyPay Loan App

What is LazyPay Loan App All About

LazyPay, powered by PayU, is the fastest way to get access to an instant line of credit online. Just enter your mobile number & discover your unique limit.

[telegram text=”Loot Deals Offers” link=”https://indianhotdeal.com/join-telegram-loot-deals-channel-mobile/”]

With quick approvals & secure online processing, LazyPay successfully disburses 1 million+ loans every month, by ensuring convenience to the consumer through our key offerings including pocket- friendly EMIs, Personal Loans, and the option to Pay Later across 100+ of your favorite apps & websites. You can get Instant Personal Loans up to Rs. 1 lac with LazyPay, through an easy digital process and minimal documentation.

Key Features of LazyPay App

- No Bank visits, LazyPay’s approval process is 100% paperless

- Get 24X7 access to credit, anytime anywhere

- Pay interest only for the amount borrowed

- Collateral free instant personal loans online, for all eligible users

- E Pay Later in One Tap at 100+ apps & websites, like Swiggy, BookMyShow and more

- Convert your high-value purchases into flexible EMI plans.

- Transfer your credit limit to the bank with just one tab

Download Latest LazyPay Apk & Check Eligibility For Loan

LazyPay extends a personalized limit to all users through a simple process:

- First Of All Download LazyPay App

- Sign up on the app by mobile number and email id

- Enter Refer code

- Provide PAN details to check your eligible limit, instantly!

- To activate your enhanced limit, submit your KYC details.

- Complete your auto bill payment setup

- You can start using your enhanced LazyPay credit limit as an instant loan, convert to No cost EMIs on partner merchants or buy now pay later

LazyPay Minimum and Maximum Withdrawal Limit

Minimum – The minimum amount for withdrawal is Rs 10,000. If your credit limit is less you can use it in 1 of the partner apps or use it for EMI purpose.

Maximum – You can withdraw Maximum up to the limit set for you. Your limit is displayed on the LazyPay Mobile app. The amount will be credited in your bank account instantly

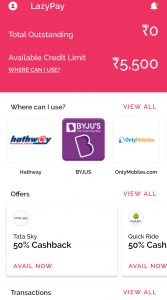

Where can you use the LazyPay wallet

1. LazyPay’s One Tap checkout is available on all your favorite food, entertainment & utility merchants, including Swiggy, Zomato, Niki.ai, AbhiBus, Box8, ACT, FreshMenu, Rapido & more

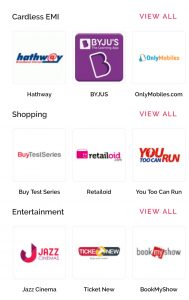

2. Cardless EMI by LazyPay is available as a Payment option to convert all your high-value purchases like home appliances, furniture, laptops, etc. into flexible plans at affordable interest rates. Select LazyPay on ZAP Subscribe – Zoomcar, OnlyMobiles, BYJU’s, Hathway, and many more coming soon!

3. Your available credit limit can be used for personal loans on education, automobile, travel, electronics & more.

4. Do a one-click transfer of your limit straight to your bank account & use as you need

5. This early salary loan is also helpful when you have to meet expenses in times of emergencies.

- Fill in a few details, to get your unique credit limit

- Instant approval to take a loan of as low as Rs 10,000

- Pay interest only on the loan amount taken

- Choose to conveniently repay with flexible EMI plans of 3-24 month

LazyPay Apps – Merchant Partner Lists

- Swiggy

- Bookmyshow

- Oyo

- Abhibus.com

- Foodpanda

- Samsung

- Act fibernet

- Niki.ai

- Hungerbox

- Rapido taxi

- ixigo

- Goibibo.com

- Box8

- Freshmenu

- Mojo Pizza

- Faasos

- I-on

- Zomato

- Ridlr

- Ticket New

- You to can run

- Tikona

- PVR Cinemas

- Komparify

- LHD food

- Act Fibernet

- Coolwink

- Hathway

- Reliance energy

- Maha Nagar gas

- Perpule

- Byju’s

- Magster

- Zap

- OnlyMobiles

Citrus Wallet LazyPay

Cash is so outdated. Online wallets are in fashion. And youth is all about fashion. Citrus Online Wallet lets you load money via cards & net banking and spend it any big digital shop. You can also secure your card information for quick purchases on the go. Also, you can upgrade your Wallet to enjoy higher limits on Loads, Withdrawals & Payments and Continue to make digital payments through your online wallet and make quick UPI repayments with LazyPay Citrus Wallet

LazyPay Latest Offers and Promo Codes 2020

- HungerBox

50% Cashback on 1st transaction & Rs. 70 Cashback on the 7th transaction

Offer details

50% Cashback up to Rs. 50 & Rs. 70 Cashback after the 7th transaction on the minimum order value of Rs. 25

- ZAPSubscribe

No Cost EMI

Offer details

At the end of LazyPay Loan App Review

Enjoy No Cost EMI on you car subscription with ZAP Subscribe powered by Zoomcar, via LazyPay.

So guys download this wonderful app and get the extra cash you need for your expenses and don’t forget to repay on time to maintain a perfect CIBIL score.